Launched in Bengaluru in 2015 by IIT Delhi graduates Vidit Aatrey and Sanjeev Barnwal, Meesho—short for “Meri Shop”—set out to revolutionize commerce in India. It facilitates a zero-investment framework for resellers via popular platforms like WhatsApp, Facebook, and Instagram, enabling millions to launch online businesses from home—particularly in Tier‑2, Tier‑3, and rural markets.

Founding Story & Early Vision

Originally providing under the name FashNear, they launched the platform to help suppliers engage sellers locally in digital channels. Soon, the founders realized the immense possibilities social media has to offer for reselling purposes and hence they converted the platform into a social-commerce application, leaving behind the traditional e-commerce infrastructure for resellers. They proudly state their mission as “Democratize e-commerce by enabling anyone to start a business without capital”.

Growth Milestones and Funding History

2016: Selected for Y Combinator and raised $120K as seed funding.

2017–2019: Went through seed to Series C funding rounds, with investors raising more than $65 million, including SAIF Partners, Sequoia, and DST, with Facebook (Meta) contributing $25 million in 2019.

2021: Achieved unicorn status by valuation to $2.1 billion after the Series D round of funding of $300 million and later raised another round of $570 million seeing it almost close to $4.9 billion valuation.

2023–2024: The Most Downloaded App Has Brought on 500 Million Downloads and More Than 14.5-Crore Downloads by 2023.

Business Model: Empowering Resellers & Suppliers

Meesho works into a B2B2C setup: suppliers list their products on Meesho; while resellers share such catalogs on social media and earn cashback margin on the orders they succeed in. Meesho takes care of logistics, return, and payments through its ecosystem—it is supposed to be easy for a non-technical seller.

Its revenues mainly come from seller advertising, logistics fees, and service charges on Meesho Mall-the company’s branded-products segment. However, the company certainly claims to follow a zero-commission model on basic listings, with profitability coming from sticker-price services. For logistics, it employs Valmo, its logistics division launched in 2024, with deliveries spanning nearly 15,000 pincodes.

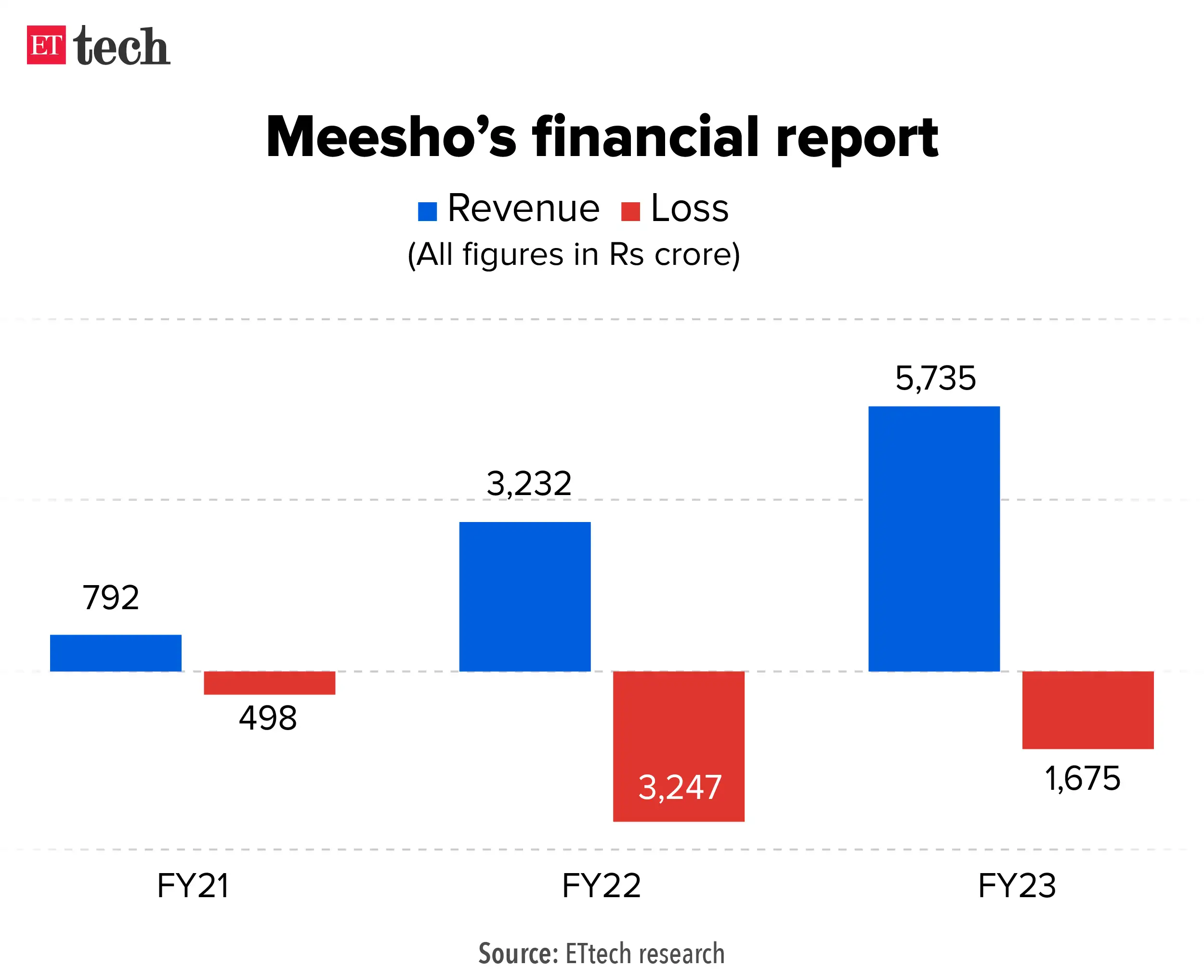

Financial Performance and Market Reach

The company had ₹7,615 crore operating revenues for FY24, reflecting a 33% YOY increase, with net losses having narrowed from ₹1,675 crore down to ₹305 crore, almost 82% down. At present, Meesho has 190 million users and 15 million-plus resellers, mostly coming from Tier‑2 and further cities.

Future Outlook & IPO Plans

Meesho has already changed its legal status to a public limited company in preparation for a proposed IPO which is preliminarily expected in late 2025 at an indicative valuation of $7–10 billion. The lead banks are Kotak Mahindra, JP Morgan, Citi, and Morgan Stanley. Though the margins are thin, the other side presses on, concentrating on controlled growth and cost-efficient structure.

Impact & Vision Ahead

Being an initial enabler for micro-entrepreneurs, especially women, Meesho got converted into a catalyst for the rise of social commerce in India. With plans to grow its business around AI-driven personalization, additional seller tools, and maybe even international markets, the Meesho story is a prime example of sustainable tech-led growth grounded in social impact.